2025 Structural Steel Industry Innovation and Upgrading: High-Strength Products Drive Dual Breakthroughs in Infrastructure and Manufacturing

Sep 20,2025

2025 Structural Steel Industry Innovation and Upgrading: High-Strength Products Drive Dual Breakthroughs in Infrastructure and Manufacturing

As global infrastructure development accelerates and manufacturing undergoes intelligent transformation, structural steel—a critical structural material—is experiencing a new wave of market demand and technological innovation. Recent industry data indicates that global section steel production grew by 8.2% year-on-year in the first half of 2025, with high-strength and corrosion-resistant products now accounting for 35% of the market—the primary driver of industry expansion.

Technological Evolution: High-Strength Section Steel Dominates Market as Green Production Technologies Take Root

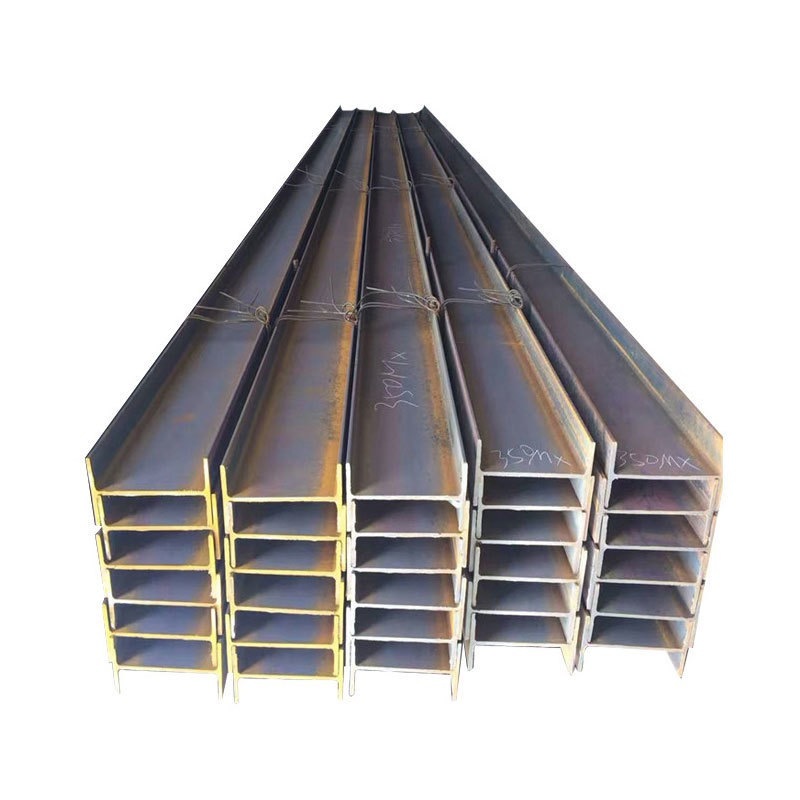

In materials technology, multiple leading enterprises have achieved mass production breakthroughs for high-strength H-beams and I-beams. Take a domestic steel group as an example: its newly developed Q690-grade high-strength structural steel, achieved through optimized alloy composition and rolling processes, boasts a 40% increase in yield strength and a 15% reduction in weight compared to traditional products. It can be widely applied in major infrastructure projects such as long-span bridges and super high-rise buildings. This product not only lowers overall project costs but also reduces steel consumption, contributing to the realization of the “dual carbon” goals.

Simultaneously, the adoption of green production technologies has become a key focus for industry transformation. Currently, 60% of the industry's structural steel production lines utilize waste heat recovery systems, reducing energy consumption per ton of steel by 12% compared to 2023. Some enterprises have introduced electric arc furnace short-process technology, boosting scrap steel utilization rates to over 90%, effectively reducing reliance on iron ore and lowering carbon emissions. These technological innovations not only enhance corporate competitiveness but also align with global trends in green manufacturing.

Application Expansion: From Infrastructure to High-End Manufacturing, Shaped Steel Demand Continues to Broaden

In infrastructure, demand for large-sized shaped steel has surged significantly with the advancement of Belt and Road Initiative projects. In a Southeast Asian cross-sea bridge project, domestically produced large-span box-shaped steel successfully replaced imported products due to its superior wind load and seismic resistance, achieving a 30% reduction in supply cycle and a 25% cost decrease. Additionally, accelerated urban rail transit construction in China has driven a 22% year-on-year increase in orders for section steel used in light rail track supports, further boosting market demand.

In high-end manufacturing, section steel applications continue to expand. In new energy vehicle chassis manufacturing, lightweight section steel reduces body weight by 8%-10%, extending driving range. In construction machinery, wear-resistant structural steel extends excavator bucket lifespan by 50%, reducing equipment maintenance costs. Industry experts note that as manufacturing upgrades toward high-end and intelligent production, customized structural steel products will become a core competitive arena in future markets.

Market Trends: Global Supply Chain Optimization and Deepened Regional Cooperation

Globally, Asia remains the primary production and consumption hub for structural steel, accounting for 62% of the market in the first half of 2025. To address supply chain volatility, multiple countries are strengthening regional cooperation. For instance, China and ASEAN nations have established structural steel production capacity cooperation bases, enabling localized raw material procurement and rapid product delivery, effectively reducing logistics costs and trade risks.

For industry enterprises, three key areas warrant future focus: First, continuously increasing R&D investment to overcome technical bottlenecks in high-strength and specialty structural steel; second, advancing digital transformation to enhance product quality stability through intelligent production systems; Third, strengthen green manufacturing capabilities to meet increasingly stringent global environmental regulations.

Industry projections indicate that driven by sustained infrastructure investment and manufacturing upgrades, the global structural steel market will exceed $800 billion by 2025, maintaining an annual growth rate of 7%-9%. The sector is poised to enter a new phase of high-quality development.

PREVIOUS:

NEXT:

Contact Us